As wonderful as Direct Primary Care (DPC) is, there is a problem. Nothing is perfect after all.

The biggest problem with DPC is that people simply don’t understand it… yet! Further, because it is different from the norm, it is a little scary.

Explaining the monthly membership idea of a DPC clinic is not too difficult because people understand how gym memberships work. Offering healthcare to those who are uninsured at a predictable, lower-than-traditional-care cost is a no-brainer. Unlimited visits and improved access to your personal physician are understandable—although may seem “too good to be true.” However, the thing that seems to be consistently the most difficult to understand is how DPC can work with health insurance and not break the bank.

In general, healthcare and health insurance are confusing. VERY confusing! PPO. HDHP. HSA. FSA. EOB. Deductible. Premium. Out-of-Pocket Max. Copay. Coinsurance. And on and on… It’s quite literally its own language.

Secondly, healthcare and health insurance are expensive. VERY expensive! Despite having health insurance, an HSA, and working in primary care for the past 11 years, I still get nervous to open EOB letters after a doctor visit.

If this is the norm, how then can patients afford and understand yet another thing in healthcare? Why in the world did we add another confusing acronym with “DPC”? Why yet another monthly expense when healthcare has most of us broke already?!?

I get it! These are the questions I’ve personally wrestled with for the past few years.

Today, let’s take the first bite into the proverbial how-do-you-eat-an-elephant?, and chew on this question for a bit: how can a DPC membership work with a “traditional” health insurance plan?

Hold on, it’s about to get a bit nerdy in here.

For most people under the age of 65, health insurance is usually designed as a “PPO plan” or a “High Deductible” Health Plan (HDHP) with an attached Health Savings Account (HSA). These are most often offered by an employer as part of a benefits package. (Some other day, we will consider Health Shares, Medicare, Medicaid, and more. For now, let’s start with the traditional PPO vs. HDHP.)

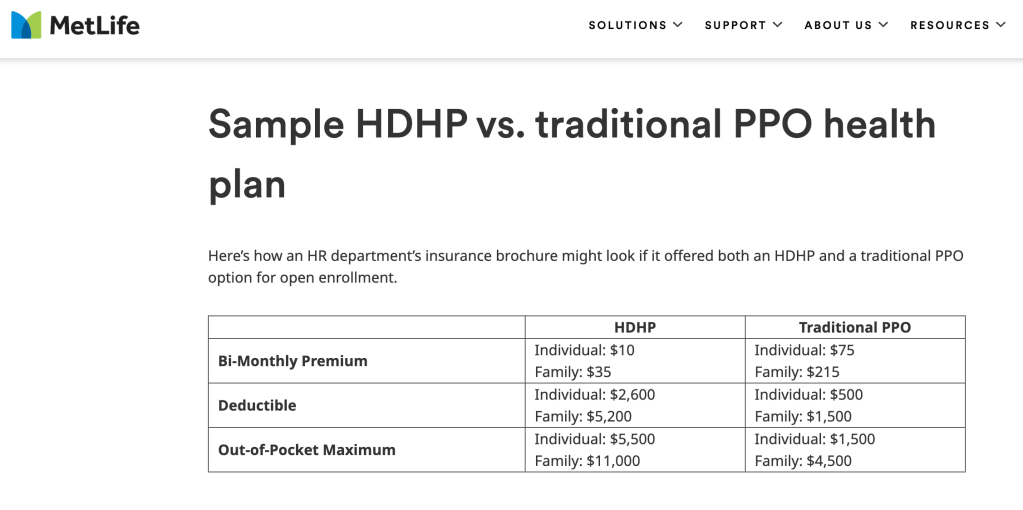

Your employer may have given you a table similar to the example below (found on MetLife.com) when you started your job and yearly thereafter.

Look vaguely familiar?

Plan A. Let’s say you are like millions of Americans and choose the PPO option. It’s more per month, but tends to cover the cost of care faster due to a lower deductible.

Plan B. Instead, maybe you choose the HDHP/HSA. The actual cost to have this plan is much cheaper. But the catch is that you will be responsible to pay for the full cost of your care until you cover the much larger deductible and eventually the out-of-pocket maximum for a particularly bad year.

If you don’t ever go to the doctor, then the HDHP will save you tons of money. However, if you get even a little sick, you’ll learn quickly how expensive healthcare can be.

If only you had a crystal ball to tell the future! Can you make it an entire year without ever going to the doctor, or could this be the year you get cancer, have an accident, or need your appendix taken out?

The truth is that typically your health is somewhere in the middle – you’ll have some healthcare needs throughout the year, but probably not enough to hit the max out-of-pocket cost outlined in your plan.

For example, maybe you get care just three times over the year. First, you go to Urgent Care for stitches because you accidentally cut your hand. Second, a visit for an upper respiratory infection with labs. And lastly, you go in for an annual wellness visit with labs. Each visit alone could easily cost $500-$1500 without insurance.

Let’s run some numbers with insurance for this “typical year.”

With Plan A (PPO), the wellness visit is covered because it is “preventative.” We’ll assume that the laceration repair and infection visits totalled $2000 to use a round number. This was billed to your insurance and then to you. You will pay the first $500 because of your deductible, and then insurance will start to kick in their share of the co-insurance for the remaining $1500 balance – usually something around 80% them, 20% you.

With Plan B (HDHP), the wellness is still covered by your insurance, but you’ll pay all of the cost of the care because of the high deductible.

Here’s the summary:

| Plan A (PPO) | Plan B (HDHP/HSA) | |

| No Care Year Cost (Premium only) | $1800 | $240 |

| Very Sick Year Cost (Premium + Out of Pocket Max) | $3300 | $5740 |

| “Typical” Year Cost (Premium + deductible, coinsurance, copay for $2000 worth of typical care) | $2620 | $2240 |

Interestingly, both Plan A and Plan B end up similar in cost for our example “typical” year.

Now, let’s shake it up and see how the math changes when you pair either plan with a DPC membership. For now, ignore the other benefits and conveniences of Direct Primary Care and simply consider the math.

So, close your eyes and imagine that you took the leap and signed up for a DPC clinic. Now, in addition to the monthly insurance premiums, you pay a monthly membership fee. Gulp!

And, let’s plan on it being the same “Typical Year” we used in the example above. You have the same three doctor visits this year – stitches, a respiratory infection, and a yearly wellness visit. With DPC, you do not have any office visit charges to see your doctor for any of those visits – no copay, no coinsurance, and nothing to pay towards the deductible. At most, for the laceration you might pay ~$40 for the suture material, and for the respiratory infection, you might pay the cash price of purchasing a strep and influenza test, ~$20. In this “Typical Year,” the total bill for care with DPC is $65 plus the membership fee.

Here’s the summary of how that cost fits with your insurance:

| Plan A (PPO) + DPC | Plan B (HDHP/HSA) + DPC | |

| No Care Year Cost (Premium + Membership $100/mo) | $3000 | $1440 |

| Very Sick Year Cost (Premium + Membership + Out of Pocket Max) | $4500 | $6940 |

| “Typical” Year Cost (Premium + Membership + $60 cash price of stitches/labs) | $3060 | $1500 |

Look again at the number for Plan B during a typical year! In this example, when you pair DPC + HDHP, the yearly cost to have health insurance AND have a wellness check-up AND get stitches AND treat a respiratory infection is only $1,500. Compare that to the “traditional” healthcare method – a PPO plan without DPC, and that same year would cost $2,620. Pairing the High Deductible Insurance plan with DPC is a 43% SAVINGS! – even after paying the monthly membership fee.

Moreover, if you saw your DPC doctor 10 more times in the year “just because,” the total cost of care would not change—still around that $1500 cost. No more guessing or riding the rollercoaster of healthcare bills in your budget.

Surely, if you’ve followed along this far, you’re thinking, “But what if …?” As you can clearly see, DPC doesn’t save everyone money. But it also isn’t as expensive in the big picture as you may have thought. So please keep asking your questions. Do the math yourself. Run your own numbers. Look at your employer’s options. (If you are the employer, talk to a good broker.) Find your old EOBs and office bills. Be curious.

Just maybe it’s time to consider your healthcare options.

As an aside, we haven’t even scratched the surface of the benefits of the Health Savings Account (HSA) that can be paired with the High Deductible plan. For now, just know that “Yes!” you can use your HSA to pay for DPC membership. Eventually, we’ll also talk about other ways you can still use your health insurance with DPC (e.g., medications, imaging, labs, specialists, …).

And, like a good infomercial – there’s more! The benefits of DPC are far beyond just the potential cost savings and price transparency. To be honest, I think the possible cost savings are just the cherry on top of better primary care.

The reality is that, at least financially speaking, DPC may not work for all, but I do think it will work for many—maybe even for you!

Leave a comment